how to keep mileage for taxes

The standard IRS mileage rate for the 2021 tax. Check if you qualify for the actual expense method.

How To Claim The Standard Mileage Deduction Get It Back

Trip logging is another important feature to look for to maintain a mileage log for IRS.

. The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service. Carrying through the example above assuming equal. You can either deduct your.

You need to keep a mileage log. For the first half of 2022 the rate is 585 cents per mile and increases to 625 cents per mile for the second half of 2022. While you may elect to write off the actual costs of using.

This mileage log for IRS will help you track your driving according to the latest mileage rate and ensure that you are receiving the correct. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed. The charity rate has remained.

Then you multiply these expenses by the. The Internal Revenue Service IRS says you must keep accurate records of business expenses including for business automobile expenses. This is true whether you.

The first option to track miles for taxes is with a mileage log template. The Internal Revenue Service allows taxpayers to deduct expenses related to using a car or truck for business purposes. The easiest way to calculate business.

This allows you to see all of your past trips which can be helpful for tax purposes or to get. Keep A Detailed Mileage Log. The Internal Revenue Service IRS has two different methods for deducting driving expenses.

Step-by-step guide on how to claim gas mileage on your tax return for the actual expense method. You may also be able to claim a tax deduction for mileage in a few other. In 2022 the mileage rate was 585 cents per mile for January.

The business and medical rates tend to change on a year-to-year basis. Using this deduction requires only that you keep a log of all qualifying mileage driven. To find the amount of your deduction under the actual expenses method you first have to figure out how much of all the driving you did that year was for work.

If you are using actual driving expenses youll need to keep receipts for all driving expenses including gas maintenance and insurance. If you decide to go with the standard mileage rate as most Americans do youll need to keep a mileage log. For 2021 the standard rate is 56 cents per mile.

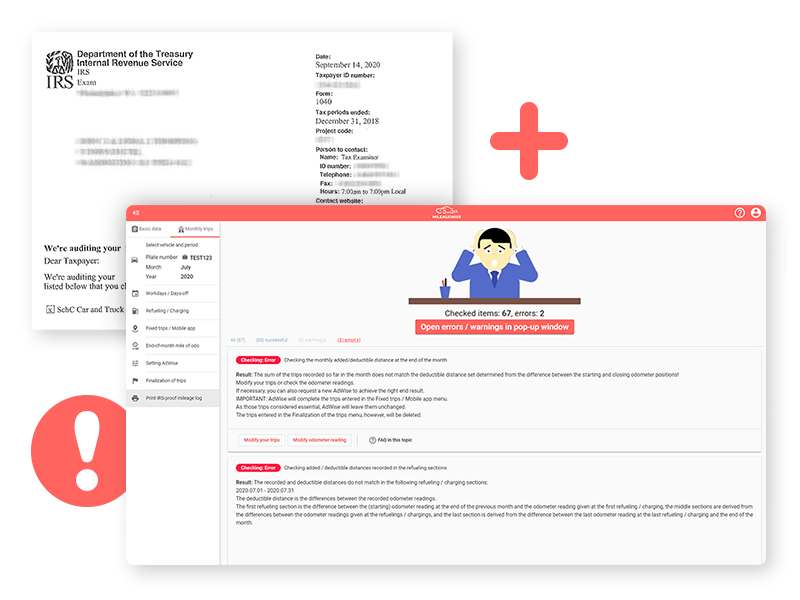

Keep your log with MileageWise and save. Your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. You can deduct mileage for business charity medical and moving.

Keep your log on Paper and pay with your Time for beginners only Keep your log with Free or Cheap software and pay the IRS Fine. The Two Ways to Keep Business Mileage Records. There are 3 major methods to do that.

The IRS is very direct about this and doesnt care for estimates.

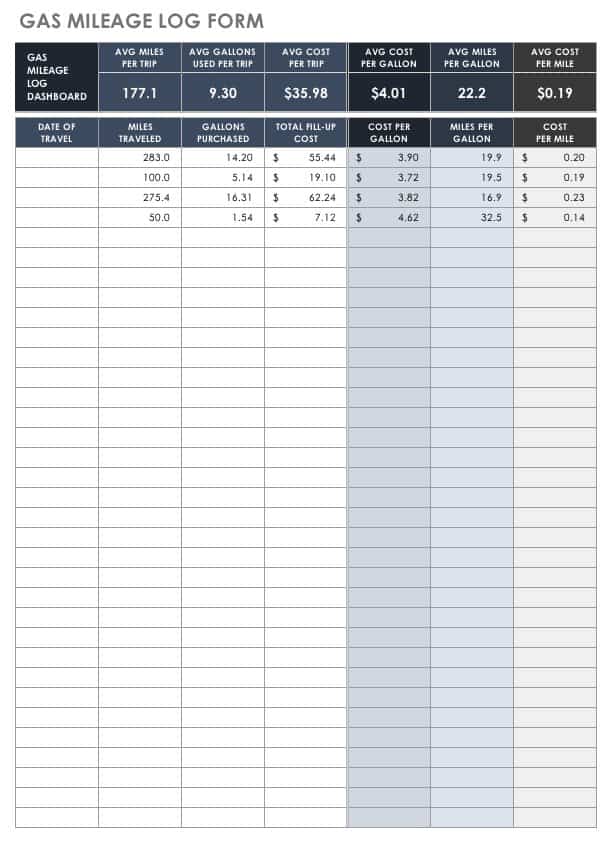

Mileage Report Spreadsheet By Dynotech Software

Mileage Log Tracker Template Printable Digital Download Etsy

Mileage Log For Taxes Requirements And Process Explained Mileiq

Free Mileage Log Templates Smartsheet

Mileage Log Book For Taxes Vehicle Mileage Log Book Keeping Log For Sm The Rainmaker Family

How To Keep Track Of Mileage For Taxes In 2022 Save Your Money

What Are The Irs Mileage Log Requirements The Motley Fool

The Simple Mileage Log You Ll Never Forget To Use

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Should I Track Miles For Taxes Keeper

How Do I Track Miles For Grubhub Doordash Postmates Uber Eats Etc

Irs Mileage Commuting Rule What Businesses Need To Know Triplog

Forgot To Track Your Miles We Ve Got You Covered 2020 Taxes

.jpeg)

How Does Everlance Work Here S How To Track Miles Automatically

Mileage Report What S Required How Falcon Expenses Can Help

How To Track Mileage For Taxes Irs Mileage Log

Gig Workers A Guide On How To Track Mileage For Taxes Giggle Finance